Geopolitical tensions have emerged as a significant driver of currency fluctuations in 2025, creating both opportunities and risks for forex traders. As reported by Finage, ongoing trade wars, regional conflicts, and shifting alliances are amplifying market movements, challenging even seasoned investors to adapt their strategies in this volatile trading environment.

Safe-Haven Currencies During Crises

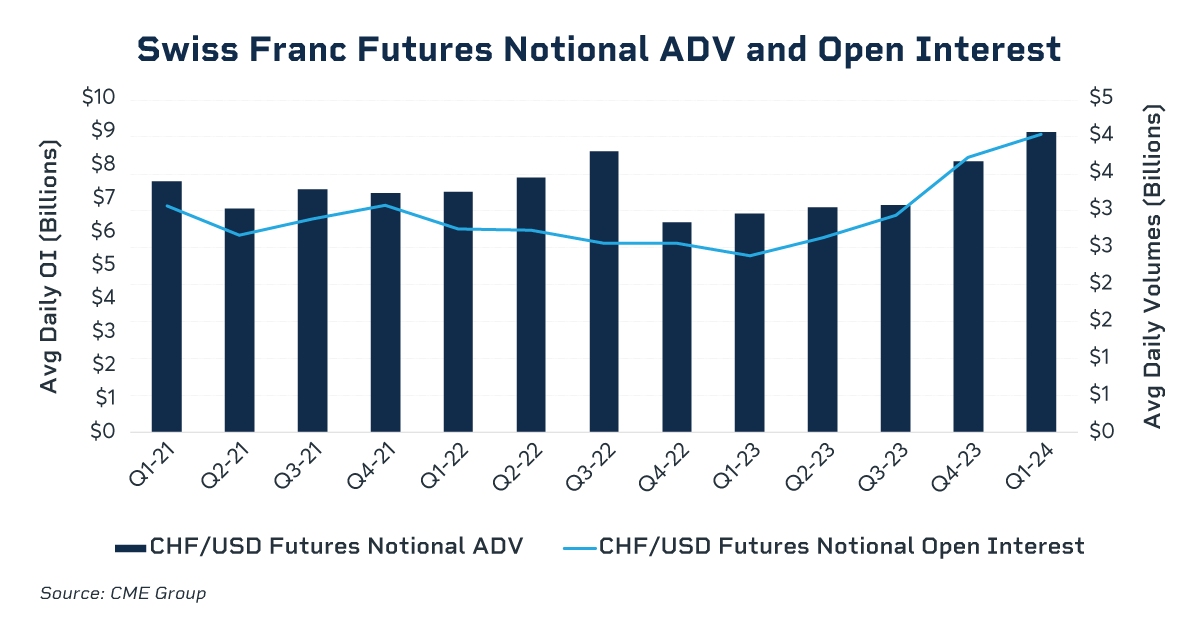

In times of geopolitical tensions and economic uncertainty, investors often flock to safe-haven currencies to mitigate financial risk. The US dollar (USD), Japanese yen (JPY), and Swiss franc (CHF) are widely recognized as the primary safe-haven currencies due to their stability and liquidity. These currencies typically appreciate during crises, as evidenced by the sharp strengthening of the US dollar against most global currencies during the financial crisis. Safe-haven currencies share common characteristics that contribute to their status:

- Strong economic fundamentals and political stability of the issuing country

- High liquidity in forex markets

- Low sovereign risk

- Large current account surpluses (for JPY and CHF)

However, the safe-haven status of currencies can shift based on global economic conditions and specific geopolitical events. For instance, the euro has emerged as a potential alternative safe-haven currency in recent years. Traders and investors should closely monitor geopolitical developments and economic indicators to anticipate potential shifts in currency dynamics during periods of market turbulence.

Impact of Trade Wars on Forex

Trade wars can significantly impact currency markets, often leading to increased volatility and shifts in currency values. The prospect of higher tariffs, as seen in potential Trade War 2.0 scenarios, tends to strengthen the US dollar. During the 2018-2019 trade war, the DXY index rose up to 10% during tariff announcement windows in 2018 and 4% in 2019.

Key effects of trade wars on forex include:

- Depreciation of targeted currencies: The Chinese renminbi depreciated by up to 10% in 2018 and 5% in 2019 as trade tensions escalated.

- Volatility in major currency pairs: The EUR depreciated by up to 10% in 2018 and 4% in 2019.

- Impact on commodity-linked currencies: Currencies tied to commodities and China, such as CLP, COP, ZAR, and BRL, were particularly affected.

- Potential currency manipulation concerns: China’s controlled devaluation led to it being labeled a “currency manipulator” by the US in 2019.

- Shifts towards safe-haven currencies: Heightened uncertainty can drive traders towards safe-haven currencies like the Japanese yen or Swiss franc.

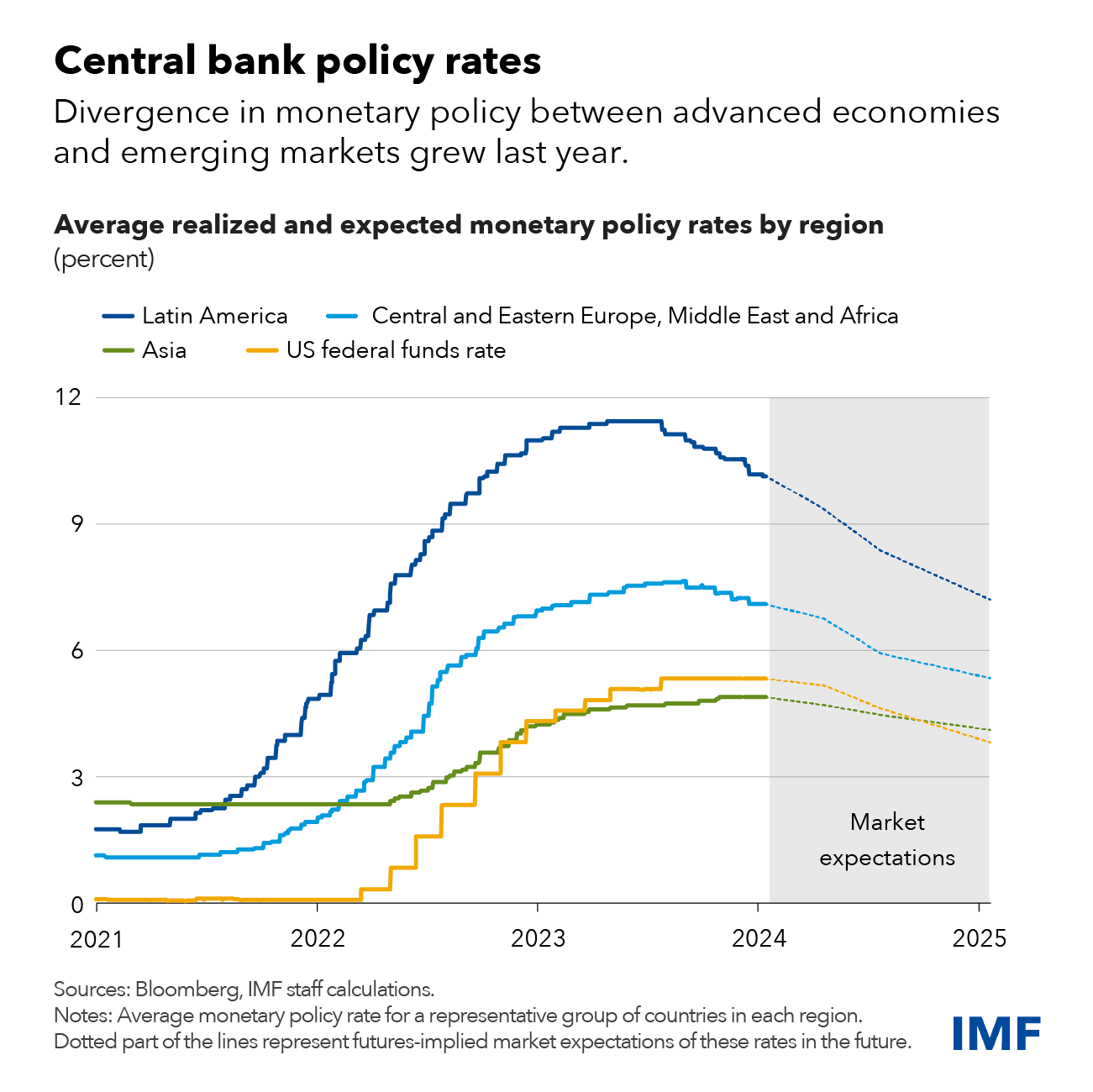

As trade tensions persist, forex traders should remain vigilant of potential tariff implementations and their broader economic implications, while also considering other crucial factors such as interest rate differentials that influence currency trajectories.

Emerging Market Currency Volatility

Emerging market currencies are experiencing heightened volatility in 2025, driven by a complex interplay of global economic factors and geopolitical tensions. The Federal Reserve’s unexpected decision to slow the pace of rate cuts has strengthened the US dollar, putting significant pressure on emerging market currencies. As a result, currencies like the Indian rupee and Brazilian real have dropped to record lows, while the Indonesian rupiah has fallen to a four-month low.

This volatility is exacerbated by geopolitical risks, which pose serious threats to financial stability in emerging economies. When financial stress is already at or above average levels, geopolitical tensions intensify instability to a remarkable degree. Foreign exchange markets in emerging economies are particularly vulnerable to these risks, suffering more severe consequences than stock markets or banking sectors. Additionally, the ongoing trade wars have led to currency fluctuations that can be destabilizing for emerging economies with less resilient financial systems. These currency swings can increase import costs, fuel inflation, and complicate external debt servicing, further challenging the economic stability of emerging markets.

Subscribe to Our Newsletter for Exclusive Updates and Insights

By subscribing, you’ll gain access to a treasure trove of valuable content delivered straight to your inbox. Stay ahead of the curve with expert articles, insider tips, and thought-provoking resources carefully curated by our team of professionals. Whether you’re a seasoned enthusiast or just getting started, our newsletter is a must-have resource for staying informed and inspired.