Gold prices have surpassed the key $2,800 mark for the first time, driven by global economic uncertainty and renewed safe-haven demand amid escalating geopolitical tensions and mixed signals from the Federal Reserve.

Impact of US Tariff Threats

The recent surge in gold prices to record highs is largely attributed to US President Donald Trump’s tariff threats against Canada, Mexico, and China. These protectionist policies have fueled concerns about potential economic fallout and higher inflation, driving investors towards gold as a safe-haven asset. The 25% tariffs on Canadian and Mexican imports, along with a 10% levy on Chinese goods, have escalated fears of a trade war that could slow global growth.

- Market reactions include:

- Spot gold climbing to an all-time high of $2,818.58 per ounce

- Increased volatility in precious metals markets

- Sharp rise in lease rates for gold and silver

- Heightened uncertainty about the full impact of the trade war

While Trump has temporarily paused tariffs on Mexico after striking a border security deal, the ongoing trade tensions continue to support gold prices. Analysts suggest that if the trade disputes persist, it could lead to significantly higher gold prices in the medium term.

Federal Reserve’s Role in Gold Prices

The Federal Reserve’s monetary policy decisions play a significant role in influencing gold prices, primarily through their impact on interest rates and the U.S. dollar. While the relationship between gold prices and interest rates is not always consistent, there are notable trends:

- Lower interest rates generally support gold prices by reducing the opportunity cost of holding non-yielding assets.

- Rate hikes can potentially weaken gold prices by making yield-bearing assets more attractive.

- The Fed’s recent rate cuts have provided a tailwind for gold, with prices reaching record highs.

- Market expectations of future Fed actions, such as the pace of rate cuts, can significantly impact gold’s performance.

However, other factors like geopolitical tensions, inflation concerns, and central bank purchases also influence gold prices, sometimes overshadowing the Fed’s impact. As the Fed navigates economic uncertainties, including inflation risks and potential policy shifts following recent political changes, gold remains an attractive hedge for many investors.

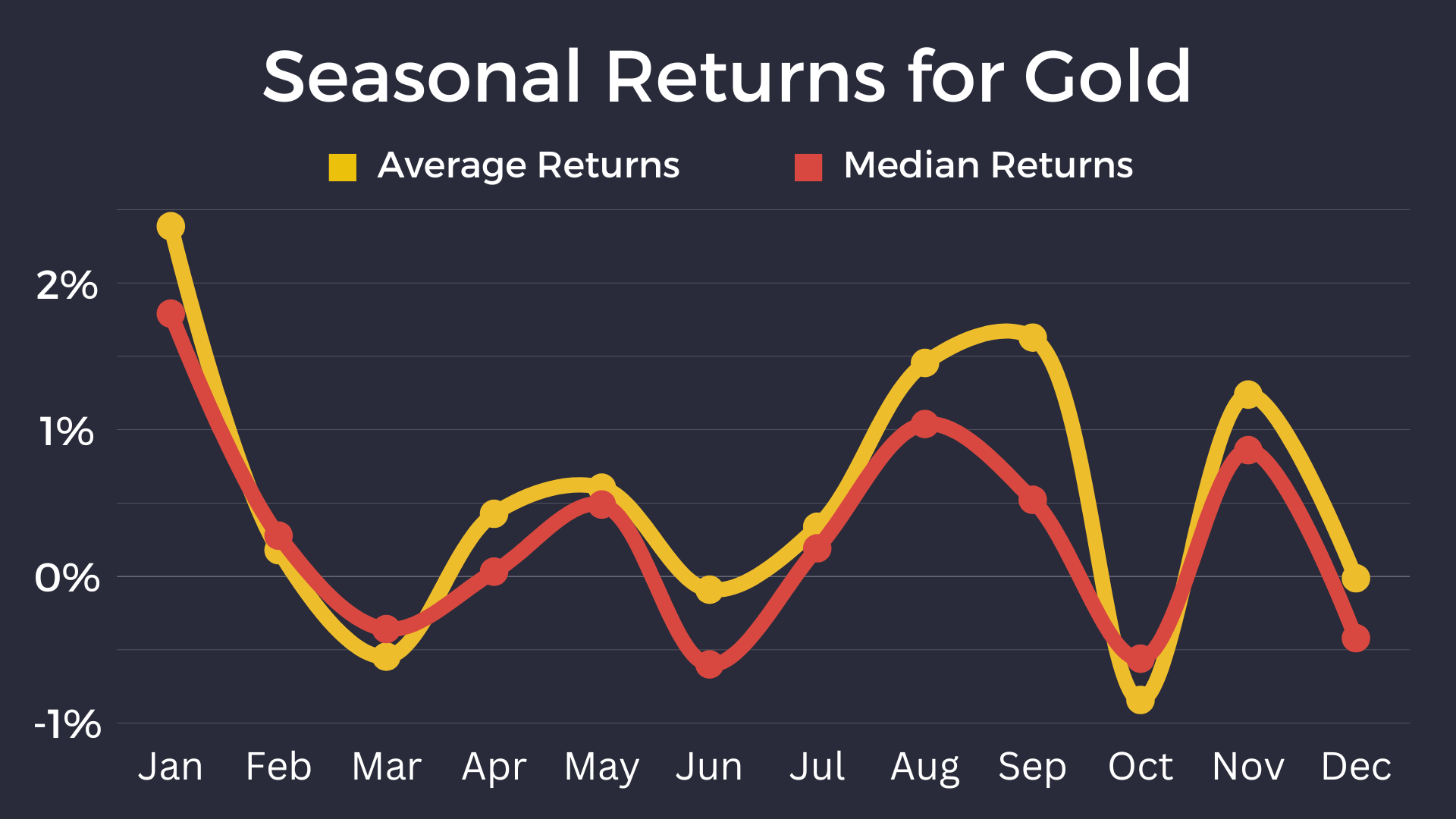

Seasonal Trends in Gold Investment

Gold exhibits distinct seasonal patterns in its price movements, with certain periods historically showing stronger performance. The most favorable period for gold typically begins in mid-December and lasts until the end of February, with a 70% probability of price increases during this time. This trend is driven by cultural factors, such as the Indian wedding season and Chinese New Year, which boost jewelry demand.

- Key seasonal trends include:

- A strong start in Q1 (January-March) due to portfolio rebalancing and Asian cultural events

- A potential dip or stabilization in Q2 (April-June)

- A resurgence in Q3 (July-September), particularly towards the end

- A robust Q4 (October-December) fueled by festivals and year-end investments

Investors can leverage these patterns by strategically timing their gold purchases and sales, though it’s crucial to consider other factors like geopolitical events and economic indicators alongside seasonality. While seasonal trends provide insights, they should not be the sole basis for investment decisions, as market conditions can vary year to year.

Subscribe to Our Newsletter for Exclusive Updates and Insights

By subscribing, you’ll gain access to a treasure trove of valuable content delivered straight to your inbox. Stay ahead of the curve with expert articles, insider tips, and thought-provoking resources carefully curated by our team of professionals. Whether you’re a seasoned enthusiast or just getting started, our newsletter is a must-have resource for staying informed and inspired.